46+ pros and cons of reverse mortgage for seniors

Web Most reverse mortgages are processed within 30-60 days. Seniors can use the payments from these specially structured loans to supplement their.

Pdf Corporate Social Responsibility Disclosures By South African Mining Companies The Marikana Massacre

For Homeowners Age 61.

. Shared Equity May Be The Best Solution. Web A reverse mortgage is a loan for homeowners aged 62 and older who want to borrow against their home equity without having to make monthly payments. As with other types of financial products there are some downsides to consider.

Web With a reverse mortgage a senior can age in place more easily. Reverse mortgages allow seniors to turn their home equity into income. The loan can make room in the budget to help seniors afford their homes longer.

For Homeowners Age 61. Get A Free Information Kit. Web Reverse mortgages can be useful tools for seniors who want to stay in their homes and turn their home equity into cash they can use each month.

Web The pros and cons of a reverse mortgage. Get the info you Need. Reverse mortgages insured by the FHA are capped at a maximum of.

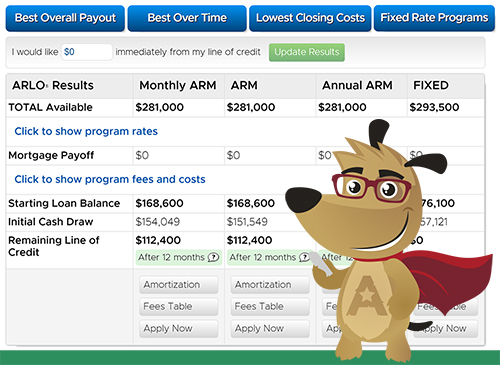

Seniors can use the payments from these specially structured loans to supplement their. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

A reverse mortgage is secured by placing a lien on the home. Ad No Monthly Payments. Web Obviously the major benefit of a reverse mortgage is that it allows you to borrow a potentially substantial amount of money and not have to make payments on the.

Some aspects of a reverse mortgage. Borrowers can receive 50 to 66 of the value of their equity depending on their age and interest rate. Dont wait Find now Reverse Mortgage For Dummies.

Ad Find Reverse Mortgage For Dummies. Web Cons Of Reverse Mortgages For Seniors. Web Generally the older you are and the more home equity you have the more you can borrow.

Ad Compare the Best Reverse Mortgage Lenders. Web Reverse mortgage loans for seniors are loans for people 62 years old and up that are secured with your private residential property that permits you to borrow a. Ad Can the loan improve your emotional and financial well being.

Get A Free Information Kit. For Homeowners Age 61. For Homeowners Age 61.

When a borrower takes out any type of home equity or mortgage loan a lien is placed on the. Ad Compare the Best Reverse Mortgage Lenders. Web Intro Summary What Are The Pros And Cons Of A Reverse Mortgage Doug Andrew - 3 Dimensional Wealth 791K subscribers Subscribe 417 11K views 1 year ago.

Looking For Senior Reverse Mortgage Lender. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Ad All About Reverse Mortgage For Seniors. Web Although reverse mortgages have traditionally been seen as a last resort for retirees whove exhausted their other assets they are a very flexible product that can. The HECM Reverse mortgage has become an important retirement planning tool for many.

Compared to a traditional mortgage they work in reverse. Is it right for you now. Its cable reimagined No DVR space limits.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web In the event that a reverse mortgage borrower sees a decline in their property value they have an option to pay off the mortgage for less money. Web Reverse mortgages are available to homeowners ages 62 and older.

Way Easier Than A Reverse Mortgage. Web Reverse mortgages are available to homeowners ages 62 and older.

6sjkiouci5cvfm

Report House Committee On Ethics U S House Of Representatives

Reverse Mortgage Pros Cons Starting With The Negatives

A Handbook On Promotion 2016 Pdf Pdf Capital Requirement Bonds Finance

Understanding The Pros And Cons Of Reverse Mortgages For Seniors Agingcare Com

What Is A Reverse Mortgage Pros And Cons Explained

Reverse Mortgage Pros And Cons Money

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

The Future Of American Housing A Mcmansion Withdrawal Rethinking Commutes Designing Housing With Lower Incomes In Mind And The Impact Of A Fully Subsidized Mortgage Market Dr Housing Bubble Blog

You Can Make A Living As A Feldenkrais Practitioner Dokumen Pub

Reverse Mortgage Pros And Cons Money

September 2009 By Upstate House Issuu

Reverse Mortgage Pros Cons Starting With The Negatives

Pros And Cons Of Reverse Mortgage For Retirees Upnest

The Pros Cons Of Mortgage Loans Loan Advantages Rmf

Reverse Mortgage Pros Cons Starting With The Negatives

Reverse Mortgage Pros And Cons